Iowa Property Tax

Property Tax | Iowa Tax And Tags

one of the county treasurer's responsibilities is to collect taxes for real estate property, manufactured homes, utilities, bushels of grain, monies and credits, buildings on leased land, and city and county special assessments, including delinquent sewer rental and solid waste rates and charges for all tax levying and tax certifying entities of …

https://www.iowataxandtags.org/property-tax/

Iowa Property Tax Overview | Iowa Department of Revenue

The Iowa property tax is primarily a tax on "real property," which is mostly land, buildings, structures, and other improvements that are constructed on or in the land, attached to the land, or placed upon a foundation. Typical improvements include a building, house or mobile home, fences, and paving.

https://tax.iowa.gov/iowa-property-tax-overview

Property Tax | Iowa Department Of Revenue

Learn About Property Tax; Learn About Sales & Use Tax; File a W-2 or 1099; Request Tax Guidance; Tax Forms. Tax Forms Index; IA 1040 Instructions; Resources. Law & Policy Information; Reports & Resources; Tax Credits & Exemptions; Education; Tax Guidance; Tax Research Library; Iowa Tax Reform; Adopted and Filed Rules; Need Help? Common ...

https://tax.iowa.gov/division/property-tax

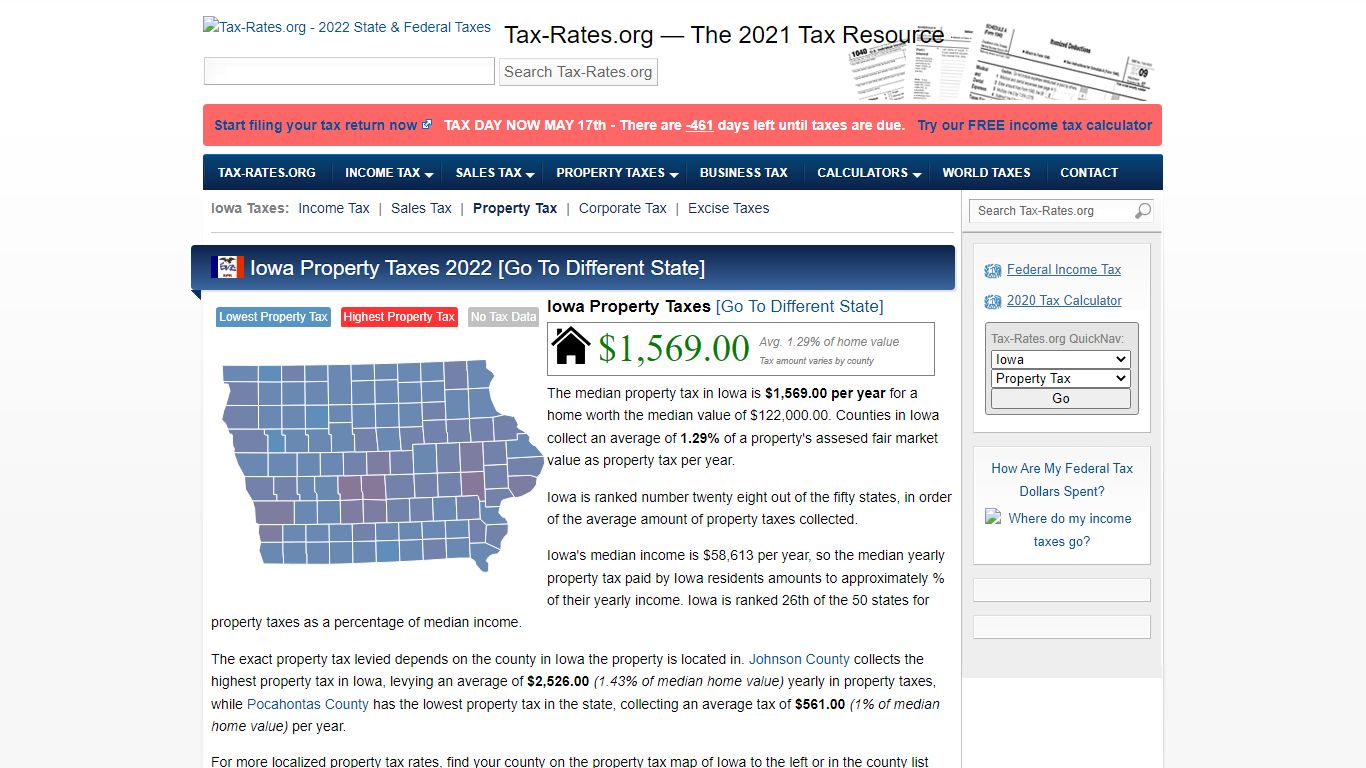

Iowa Property Taxes By County - 2022 - Tax-Rates.org

The median property tax in Iowa is $1,569.00 per year for a home worth the median value of $122,000.00. Counties in Iowa collect an average of 1.29% of a property's assesed fair market value as property tax per year. Iowa is ranked number twenty eight out of the fifty states, in order of the average amount of property taxes collected.

https://www.tax-rates.org/iowa/property-tax

Property Taxes | Iowa Department Of Revenue

Iowa Property Tax Credit Claim 54-001. Read more about Iowa Property Tax Credit Claim 54-001; Print; Pagination. Page 1 ; Next page ...

https://tax.iowa.gov/tax-type/property-taxes

Iowa County Treasurers

Property Tax Information: Property taxes may be paid in semi-annual installments due September and March. The Amount Payable Online represents all taxes that are payable online for each parcel listed in either the first (September) or second (March) payment period. Full or partial payments of current and delinquent taxes will be accepted at any ...

https://www.iowatreasurers.org/Property Tax - Utilities | Iowa Department of Revenue

Property Tax Replacement and Statewide Property Tax Senate File 278 redefines a new electric power generating plant, extends the life of the utility replacement tax task force, and requires notification by the taxpayer to the department of revenue and local taxing district upon transfer of utility property.

https://tax.iowa.gov/property-tax-utilities

Property Tax - Polk County Iowa

7 a.m.-5 p.m. Mon-Fri. | Open 9 a.m.-5 p.m. on the third Thursday of every month. Hours may vary for different types of transactions. Please see contact information for the Vehicle and Property Tax divisions for more details on their hours. Vehicle 515-286-3030 Property Tax 515-286-3060 Fax 515-323-5202 [email protected]

https://www.polkcountyiowa.gov/treasurer/property-tax/

Property Tax - Treasurer - Lyon County, Iowa

Partial payments are allowed on current property taxes. Iowa law prohibits partial payments on tax sale redemptions or special assessments. Delinquent Taxes Delinquent taxes accrue interest of 1.5% per month, per parcel, rounded to the nearest dollar with a minimum penalty of $1.

https://lyoncounty.iowa.gov/treasurer/property_tax/

Assessor Property Tax Rates- FY2023 | Iowa Department of Management

Assessor Property Tax Rates- FY2023. This document contains property tax rates by assessor for fiscal year ending June 30, 2023. Date Published. 08/10/2022. File (s) fy23_assessor_rates.xlsx. Fiscal Year.

https://dom.iowa.gov/document/assessor-property-tax-rates-fy2023

Property Search - Iowa Treasurers Site

Property Tax Information: Property taxes may be paid in semi-annual installments due September and March. The Amount Payable Online represents all taxes that are payable online for each parcel listed in either the first (September) or second (March) payment period. Full or partial payments of current and delinquent taxes will be accepted at any ...

https://www.iowatreasurers.org/parceldetail.php